Tech providers

25 July 2024

‘Data is the core to painting the picture’

To harness sustainability-linked loans and improve the top and bottom lines of portfolio companies, GPs need to solve the data challenge

26 July 2024

Sesamm launches ESG heatmap

Company aims to allow clients to manage their ESG reputational risk

26 July 2024

Robin AI picks Singapore for Asia hub

Geographical expansion comes after doubling footprint in New York

25 July 2024

Bunch Capital raises Series A

The Berlin-based fintech is planning to launch UK operations soon

25 July 2024

Canoe welcomes Osyte aboard

Collaboration to provide mutual clients with streamlined workflows for connecting documents and data

23 July 2024

MSCI launches private capital indexes

Company aims to enhance transparency and innovation in private markets

22 July 2024

Profile: Karen Sands, COO, Federated Hermes Private Equity

From psychology to finance; from finance to COO; Karen Sands charts her professional journey, highlighting how her interpersonal skills have helped her reshape teams

18 July 2024

Holland Mountain teams up with 73 Strings

Partnership aims to optimise GPs’ operating models

17 July 2024

Arcesium launches investment lifecycle management platform

Product constitutes bid to support GPs with driving operational alpha by optimising middle- and back-office processes

11 July 2024

The Drawdown Awards 2024: Viva Altvia!

The Drawdown speaks to Brie Aletto, CEO of Altvia about its success at The Drawdown Awards

8 July 2024

Apiday receives €10m in Series A

The ESG data firm will use the funding to expand its team

1 July 2024

Conundrum of ESG choice

Amid a myriad of software, partnerships and consultants, how do GPs make the right choice?

27 June 2024

S&P launches Peer Comparables

The update will be incorporated into portfolio monitoring platform iLEVEL to enhance valuations comparisons between public and private companies

25 June 2024

Blueflame AI receives $5m Series A

Funding came from undisclosed partners and was accompanied by contributions from the management team

20 June 2024

My fair value

Are auditors approving VC fair value according to IPEV under false pretences?

19 June 2024

Validus adds pre-trade check functionality

Company aims to streamline risk management workflows and improve operational efficiency for clients

18 June 2024

Blueflame AI partners with Encore Compliance

Gen AI-based platform has been enhanced to allow fund managers to review expert call surveillance and investment research compliance processes

18 June 2024

Persefoni partners with First Street

Partnership instigates launch of climate physical risk tool

18 June 2024

Abacus Group acquires Tribeca

Integration to grow Abacus’s business and offer services to Tribeca’s clients

17 June 2024

Venture360 launches investor reporting tool

Tool transmits all relevant reports and KPIs to provide investors with on-demand access

14 June 2024

Anduin launches investor data management

Tool should streamline processes and improve investor workflows

14 June 2024

73 Strings appoints head of alternative asset solutions

Celine Bes joins the fintech firm from Goldman Sachs

14 June 2024

Robin AI launches contracts report builder

Robin AI Reports automatically generates and reviews legal contract reports

13 June 2024

S64 welcomes CTO

Marcus Glover was previously managing director at Bank of Singapore, Deutsche Bank and UBS Investment Bank

12 June 2024

MSCI launches gen AI investment risk modelling tools

AI Portfolio Insights and Macro Finance Analyzer are available via the firm’s tech platform MSCI ONE

12 June 2024

Preqin launches Transaction Intelligence

Available via Preqin Pro, the tool is aimed at helping PE firms to better analyse deal performance and valuations

12 June 2024

AlphaSense snaps up Tegus

Transaction to integrate Tegus’s data into AlphaSense; latter raises $650 in additional funding

11 June 2024

Passthrough partners with Entrilia

Partnership aims to automate the investor onboarding process

11 June 2024

Apex and ACA team up

Partnership creates co-referral arrangement to enhance overall customer experience

10 June 2024

FundGuard teams up with ICE

Partnership to allow users to access ICE’s pricing and reference data through FundGuard

7 June 2024

FIS launches climate risk financial modelling tool

SaaS offering to support clients with assessing, reducing and reporting risks tied to climate change

6 June 2024

Dasseti receives $4.3m in Series A extension

Fresh funds to be deployed across AI, ESG, workflow automation and international growth

5 June 2024

Intapp partners with Bite

Partnership aims to enhance investor management through integrated portal in DealCloud

3 June 2024

In Conversation: Connecting high tech with high touch

As processes become increasingly automated and data determined, what role will personal connections and interaction play in the future of private markets?

31 May 2024

Canoe and InfoGrate partner up

The consulting partnership is aimed at providing outsourced CTO services to family offices

31 May 2024

Broadridge snaps up AdvisorTarget

Acquisition to assist asset managers with targeting the right advisers and driving growth strategies

30 May 2024

Ely Place and Navable launch onboarding platform

Free-to-use tool streamlines onboarding process for private market funds

29 May 2024

Beauhurst launches ESG dataset

Tool to support users in identifying investment opportunities and evaluating current portfolios

29 May 2024

Edda launches Hera AI

The Drawdown catches up with CEO and founder Clémént Aglietta post-launch to discuss the new tools

29 May 2024

Leverst launches relationship tracker

Company aims to shine light on dynamics of LBO transactions in the DACH market

28 May 2024

Position Green launches ESG DD tool

Tool to include ESG measures, pre-mitigation risk levels identification, and recommended mitigation actions

24 May 2024

Fair HQ and Ciphr team up

Collaboration to help firms accelerate their DEI progress and embed behavioural change in the workplace

24 May 2024

Aduro Advisors receives investment from Vitruvian

Fresh funds to support long-term strategic growth

23 May 2024

Manaos updates SDR reporting solution

Alternative asset managers can make use of the platform’s database of more than 20 ESG tech providers to help with impending SDR reporting

23 May 2024

Top of the ops: Me, myself and AI

TOTO is back – and this time we put Gen AI risk management under the lens with John Frizelle, CTO at Sure Valley Ventures

22 May 2024

Novata receives fresh funds

Repeat investors Hamilton Lane and S&P Global are joined by Motive Ventures; fresh capital to support platform development and geographical expansion

20 May 2024

M&A Source partners with ShareVault

Collaboration to enhance the management of high-volume transactions

20 May 2024

Teragonia and Dataiku partner up

Analytics engineering and AI tools for private equity value creation

14 May 2024

Goodwin and Passthrough deepen partnership

Tech provider's e-subscriptions offering integrated into law firm’s services

8 May 2024

Daloopa closes on $18m in Series B

Total of $18m raised to go to product development and market expansion

7 May 2024

Corlytics snaps up Deloitte regtech platform

Following investment from Verdane, the company expands its geographic reach and augments service capabilities

6 May 2024

In Conversation: Connecting private markets through AI

The next generation of AI tools have the potential to transform private markets but how widespread is their adoption by GPs, their service providers and LPs?

6 May 2024

Q&A: Automation evaluation

Jeremy Hocter, managing director at Holland Mountain, explains which AI tools have the strongest use cases for private equity

6 May 2024

Strength trAIning

Three ways to nurture generative AI to enhance operational resilience strategies

3 May 2024

Inex One launches collaboration platform

Tool to connect strategy teams and investors with expert networks

1 May 2024

BlackSwan Cyber launches cyber DD and management tool

Tool to assist with cybersecurity DD on potential acquisitions and monitoring across existing portfolio

29 April 2024

Anaplan acquires Fluence Technologies

Acquisition adds consolidation capabilities into connected planning platform

29 April 2024

73 Strings attaches audit mode

Company aims to increase data transparency for fund managers

25 April 2024

Globacap and Tokeny team up on tokenisation

Partnership aims to enable secondary markets execution, streamline workflows and ensure record integrity

24 April 2024

SimCorp launches integrated portfolio management platform

SimCorp One is the second part of the firm’s offering after Point Solutions, powered by Axioma

Operational Technology Report 2024

Our 2024 Operational Technology Report - with in-depth analyses of the latest tech state of play in midmarket PE, profiles of key operational leaders, and more - is now available to download.

24 April 2024

Calculated risks

In a volatile macroeconomic environment, it is key to continuously assess challenges and changes in the marketplace, according to Tim Eberle from the Citco group of companies (Citco)

24 April 2024

The key to solving the private wealth puzzle

Unlocking capital from non-institutional investors has always been a tough nut to crack for private equity managers, but tokenisation could provide a solution

24 April 2024

An industry in flux

Nicc Wright, chief operating officer at Daappa, outlines the imperative for data sovereignty, transparency and control in a tightening regulatory landscape

24 April 2024

Forging the path to democratisation

Providing all types of investors, from institutional to retail, with access to alternatives is vastly increasing the administrative burden on back and middle offices. But technology can provide a solution, says Anduin’s Eliot Hodges

24 April 2024

Quality control

Ensuring the quality of underlying data is vital, say Lantern’s Charlie Markham (pictured) and Aztec Group’s Matt Horton and Geraldine O’Rourke

24 April 2024

Leveraging potential

Tim Friedman, head of commercial at private equity consulting firm Holland Mountain, explains how technology can support the market

24 April 2024

How can technology streamline market processes for operational professionals?

Implementing and updating digital strategies not only enhances value creation but creates new sources of value, writes Beth Brearley

24 April 2024

Fund financing 2.0

The rapid evolution in the space calls for more robust tech capabilities to fully harness its potential, says Hazeltree's Phil McKendry

24 April 2024

Private equity’s operational upgrade

Private equity firms used to be able to run on spreadsheets and small back office teams. But as regulation intensifies and investor expectations rise, the legacy private equity operating model requires improvement

23 April 2024

Freyda partners with Fencore

The data extraction specialist joins forces with the data management platform

18 April 2024

Ocorian launches ESG reporting tool

The SFDR and SDR reporting tool is powered by technology from Treety

16 April 2024

Chronograph launches Chrono AI

The tool will assists LPs with portfolio monitoring and analysis

16 April 2024

Ark launches automated fund accounting solution

The cloud-based technology supports fund administrators and GPs with fund operations and investor relations

12 April 2024

Manaos and SESAMm team up

Partnership to provide ESG controversies data for LPs, asset managers and private equity firms

12 April 2024

Fundwave launches AI assistant

Users may extract information about their fund documentation within Fundwave’s software

11 April 2024

Rio launches 2.0 version

Updated product to assist with managing regulatory landscape of sustainability

11 April 2024

Abacus appoints CEO

Anthony J D’Ambrosi takes over from founder Chris Grandi, who is taking up the mantle of chair

11 April 2024

Preqin launches ESG performance benchmarks

Offering to support LP investment decision-making, GP’s ESG reporting and ESG intelligence for advisers

10 April 2024

Pactio receives $14m

Series-A funding for the AI-integrated transaction management platform is led by EQT Ventures

9 April 2024

Verdane backs Corlytics

Fresh funds to support organic growth, M&A activity and investments in “intelligent offering”

9 April 2024

Dasseti and Colmore form partnership

The combined forces aim to improve LP post-investment and ESG managed service data collection and reporting

9 April 2024

Zanders acquires RiskQuest

Risk management consultancy expands its presence in Europe by absorbing RiskQuest’s Amsterdam HQ in addition to 11 other international offices

8 April 2024

Equipped.ai launches AI solutions

Company’s platform now includes LLM-based chat interface, a “virtual personal assistant” and onboarding workflow system

8 April 2024

Gen II launches data management tool

Company aims to integrate fund data admin with in-house teams and third-party platform, streamlining access

8 April 2024

ORC and Dasseti partner up

The investment advisory firm aims to improve its ODD services with the partnership

8 April 2024

LeadingMile integrates TARA into Salesforce

The technology consultancy’s automated CRM testing tool can now be integrated into any web-based application, according to the founder Martijn Voorhaar

8 April 2024

Profile: Dorothea Sztopko, Golding Capital Partners

Heralds COOs as the agents of change, discusses their role in digital transformation and highlights the importance of communication

5 April 2024

Video: Technology trends

We speak to some of the attendees at our Tech Innovation Conference 2024 about cybersecurity, AI, digital integration and picking the right tech provider

4 April 2024

Maestro launches ESG survey module

Company aims to support GPs with tracking portfolio ESG data

4 April 2024

Clearwater acquires risk solutions from Wilshire Advisors

Wilshire’s Axiom, Atlas, Abacus and iQComposite will be incorporated into Clearwater’s risk and performance analytics platform

4 April 2024

In Conversation: Solving for valuations with technology

Highlights from a recent breakfast event in London hosted by The Drawdown on importance of getting valuations right, not just for reporting purposes but also for value creation

3 April 2024

Apex continues tokenisation expansion

After investing in Tokeny in December 2023, the fund admin is further expanding its tokenisation practice to facilitate investor access

2 April 2024

Persefoni releases Scope 3 supply chain management software

Persefoni Pro enables portfolio companies to easily report GHG emissions

28 March 2024

Treble Peak and Logiver team up

Partnership to facilitate access to PE funds for wealth management firm

27 March 2024

5 minutes with… Myles Milston, co-founder and CEO of Globacap

The co-founder and CEO discusses how the Globacap mission has evolved and grown since launch and assess the digital sophistication of private markets

27 March 2024

FundGuard closes on $100m in Series C

Fresh funds to support product innovation and continued onboarding of new and existing customers

26 March 2024

GPs express concerns over data management and coordination of third-party portfolio monitoring tools

Latest report from Acuity Knowledge Partners reveals issues with data management and extraction

26 March 2024

Citco launches document management platform

Offering to combine company’s AI with fund reporting expertise to extract structured data from fund documents

21 March 2024

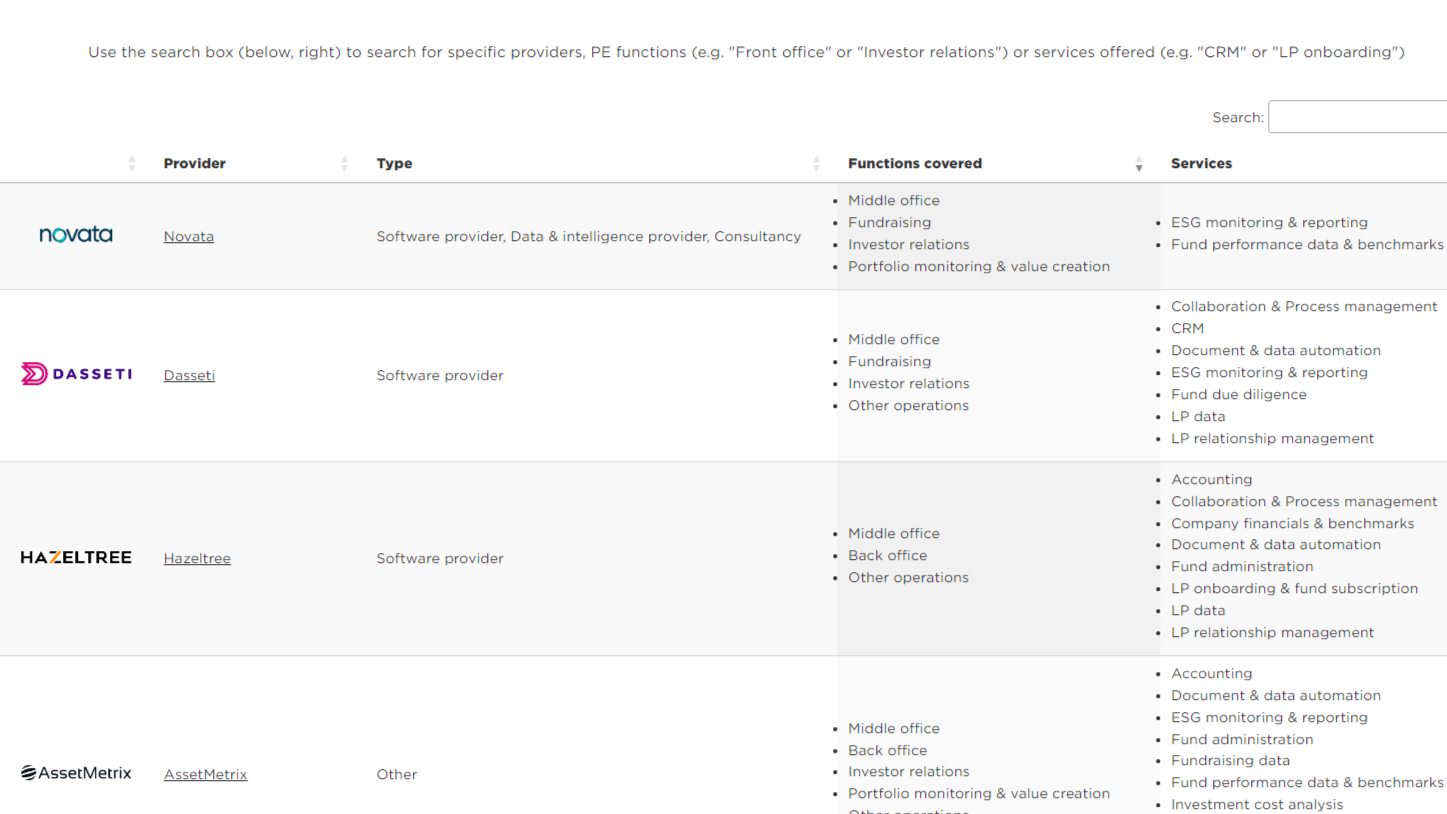

Introducing The Drawdown’s tech provider profiles

The Drawdown is mapping out the universe of software, data and service providers to help GPs navigate this rapidly evolving space

Technology Report 2024

Welcome to the first instalment of the Technology Report, which shines a light on GPs at the cutting edge of tech adoption for front-office functions, and the providers powering that transformation

20 March 2024

Domos FS partners with Cascade

Partnership will allow Domos FS’s clients to rely on Cascade for AML and KYC matters

20 March 2024

ESG considerations are here to stay

Dasseti’s Billy Cotter and Evan Crowley discuss the most talked-about acronym in the private equity industry

20 March 2024

Case study: A customised approach

Kim Carter from LKCM Headwater and Passthrough’s Ben Doran explain how collaboration is key for a successful partnership

20 March 2024

Going digital

Nicholas Neveling explores how GPs are harnessing big data and AI not only to boost portfolio company performance, but also to provide a competitive edge when it comes to sourcing and executing deals

19 March 2024

Chronograph and Quantspark partner up

The two fintech companies aim to consolidate their GP and LP client base to improve portfolio monitoring and value creation processes

18 March 2024

Atominvest partners with Greenly

Partnership to make Greenly’s carbon calculation platform accessible to Atominvest’s clients

18 March 2024

S&P makes CapIQ Pro updates

Users of the platform can now access an advisory and underwriting page, among several other performance enhancements

18 March 2024

Exchangelodge receives investment from Innovation Works

Fresh funds to broaden existing offering and accelerate global market penetration

15 March 2024

RobinAI integrates Claude 3

The AI legal chatbot has partnered with Anthropic since 2022

14 March 2024

Hazeltree adds remote access to treasury platform

Other product updates include the addition of a mobile transaction approver application